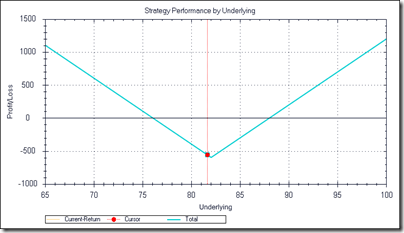

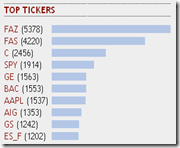

I’ve been playing around with ETFs for a while and thought about a way to generate a considerable profit from them. Option traders are familiar with time decay but it also applies to leveraged ETFs. This ETF time decay is a result of the fund management fees, leverage financing interests and other expenses. Since November 2008, there are 2 interesting funds for this strategy: The Direxion Financial 3X ETFs. FAS is long the financial market and FAZ is short the financial market, both using 300% leverage. These ETFs are very popular and are traded in the tens of millions shares a day which make them good candidates for short selling.

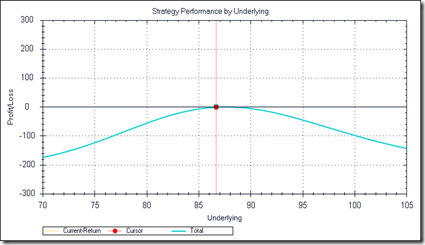

While I was looking around for information on this strategy, some people rightfully said “they cannot go both to 0”. This may be true but that’s not the object of this strategy. Here, we want to re-hedge the positions daily to balance the dollar amount on FAS and FAZ. This way, we profit from the downward bias on both funds and we are hedged against the market since the net delta of this position is near 0 and readjusted to 0 every day.

The strategy is: everyday, at close time, balance the positions on FAS and FAZ to have the same short dollar amount resulting in a net delta of 0. A quick backtest starting with a short position of $5000 on each ETF shows:

| Start amount | $ 10,000.00 |

| Gross profit | $ 2,975.22 |

| Fees ($0.005/share) | $ 376.31 |

| Days | 125 |

| Annual return % | 87% |

| Annual return | $ 8,687.64 |

| Average win $ | $ 107.06 |

| Average loss $ | $ (60.10) |

| Wins | 48 |

| Losses | 36 |

| Win % | 57% |

These are some interesting results! Excluding slippage, and margin requirements, this would yield a compounded annual 87% return. If your broker allows it, you can put the money for the margin requirement in a T-bill for a small return on that unused amount. This clearly shows that holding FAS or FAZ long for more than a few days is a very bad idea: it will eat through your cash.

These are some interesting results! Excluding slippage, and margin requirements, this would yield a compounded annual 87% return. If your broker allows it, you can put the money for the margin requirement in a T-bill for a small return on that unused amount. This clearly shows that holding FAS or FAZ long for more than a few days is a very bad idea: it will eat through your cash.

Note: I haven’t tested this strategy. If you are aware of any reason why it would not work, please let me know. As of this writing, the short availability for FAS and FAZ is around 400,000 shares each with my broker.

Update: I fixed the annual return percentage and amount calculations. The 126% figure was wrong. It actually is 87%.

Update 2: As pointed out by AJG, watch out for dividends. As a reminder, when you are short, you have to pay the dividend. Usually the stock will drop by the same amount as the dividend so this isn’t a big problem.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=3199926f-a0c8-48d0-b920-97e973c86375)

Then comes

Then comes ![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=b78902f4-3dec-4f19-9bc7-2cf475812d59)