Back on the option trading strategies, today I’ll explain the long straddle. This strategy is initially Delta neutral, which means it doesn’t change a lot when the price stays the same. How is that profitable? When the underlying price changes a lot, either way, this strategy generates a profit. This position is also called a “long volatility trade”. This means it makes a profit when the underlying price volatility increases, even if the price doesn’t move, such as before a big event or earnings release.

The long straddle is formed using 1 call and 1 put at the same strike and same expiration:

- Long 1 call, at the money

- Long 1 put, at the money

Risk

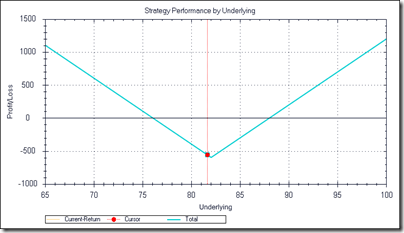

The maximum risk for this strategy is the amount paid for the initial position. There are no margin requirements. The maximum profit you can get is unlimited on both sides. The upside breakeven price is the amount paid for the position plus the call strike price. The downside breakeven price is the put strike price minus the amount paid for the position.

Entry rules

- Implied volatility should be lower than the historical volatility.

- There is a price consolidation in the underlying stock.

- If expecting a big move after earnings announcement or event, make sure the volatility isn’t too high when opening the position because volatility will drops dramatically after the event.

- When buying before an event, try to enter the position 2 to 3 weeks before the release date, when option volatility is still low.

- Make sure the stock has a history of high price movement after earnings announcements.

Exit rules

- Close the position at least 20 trading days prior to expiration if there was no price movement.

- Close the position after the earnings announcement or event. If the stock has moved a lot since the position was opened, consider closing the position right before the announcement because the stock may go back to where is was.

- Close the position when a profit of 50% has been reached, considering opening cost of the position.

Strategy graph

The performance graph for this position when bought:

Performance graph at expiration:

Volatility graph when bought:

No comments:

Post a Comment