I’m back from my blog world vacation. I wasn’t drinking margaritas on the beach but mostly filing taxes for a few people and working overtime on an iPhone application for a demo in Boston last week. The markets have been quiet lately and this means it’s time for a few calendar spread option plays.

The calendar spread can be done using calls or puts, depending on the implied volatility bias and which side you anticipate the market to go. Calendar spreads are best suited when used in a stable market or during a period of consolidation. Using them on ETFs is a good way to avoid exposure to a single company. The call calendar spread is established by buying a long term call with at least 3 months to expiration and selling a short term call with less than 45 days to expiration, at the same strike price:

- Long 1 call, at the money or slightly out of the money with more than 3 months to expiration

- Short 1 call, at the same strike with less than 45 days to expiration

This strategy works by capturing the time decay on the short term option while protecting the position with a long term option. Also, when the short term option expires, it’s possible to sell an other short them call against the long term call to keep the position running.

Risk

The maximum risk for this strategy is the amount paid for the initial position. The maximum profit varies with the volatility. The break even prices are also determined by the volatility.

Entry rules

- Implied volatility of the front month should be 15% higher than the IV of the bought call.

- There is a price consolidation in the underlying stock.

- Aim for a $2 debit per contract.

Exit rules

- Close the position during the expiration week of the sold option or let the short expire worthless then sell long call on the next business day.

- If you want to keep the position open, roll the short option forward during the expiration week if the long term purchased option still has over 2 months left to expiration.

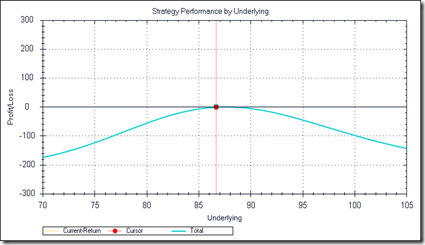

Strategy graph

The performance graph for this position when bought:

Performance graph at expiration:

Volatility graph when bought:

No comments:

Post a Comment